Citylitics continues our analysis of emerging infrastructure market trends as a result of the Infrastructure Bill. We explore funding sources to highlight trends emerging from the Bill, aggregated from council meeting minutes & agendas, capital plans, infrastructure plans, and permits from over 20,000 municipalities and 3,000 counties. This includes references to the Bill, or ‘mentions’, in public documents and surrounding context as of the end of January.

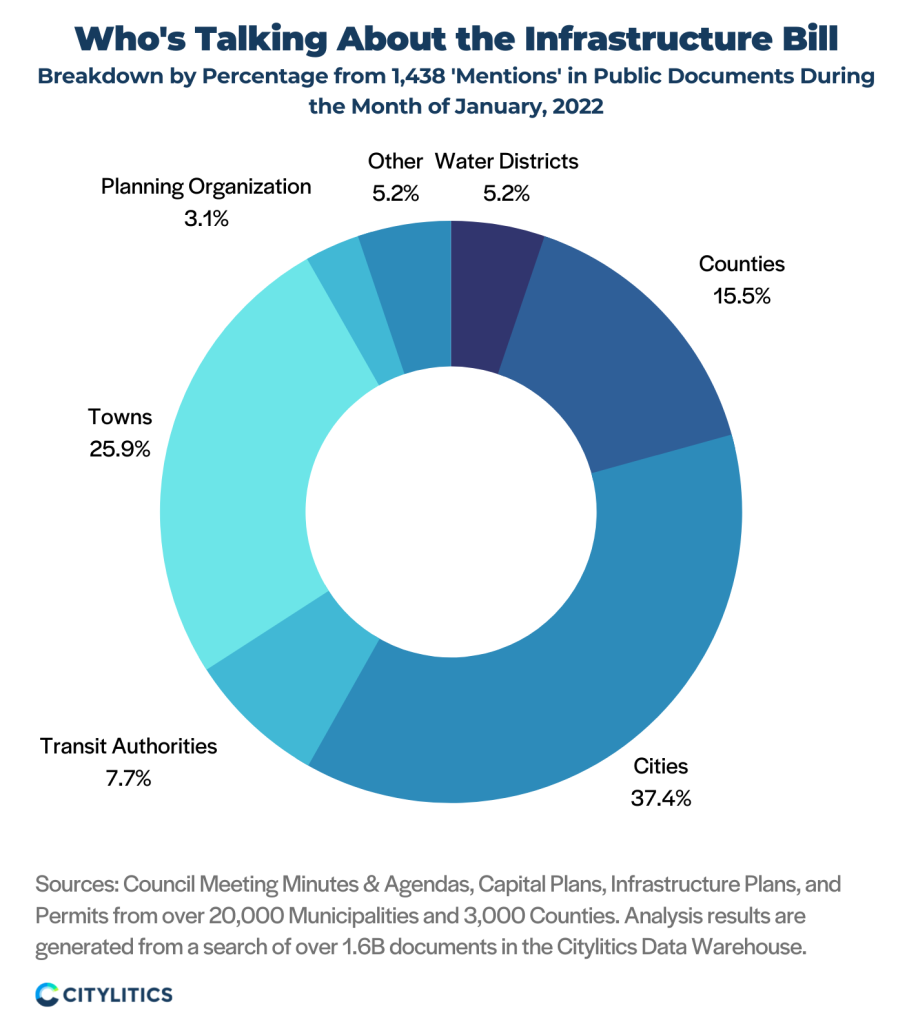

Which Entities Are Actively Discussing the Infrastructure Bill?

After seeing planning conversations nearly double by the end of November, city governments continue to be the most actively engaged in planning around Infrastructure Bill funding (37.4% of mentions). Water/sewer districts, on the other hand, saw planning conversations slowly increase during the first month the Bill passed, only to witness a sharp decline by the end of January (-4.8% change in mentions).

Engagement levels have remained relatively the same from the end of November to the end of January within transportation authorities (+2.2% increase in mentions), towns (+1% increase in mentions), and counties (+0.9% increase in mentions).

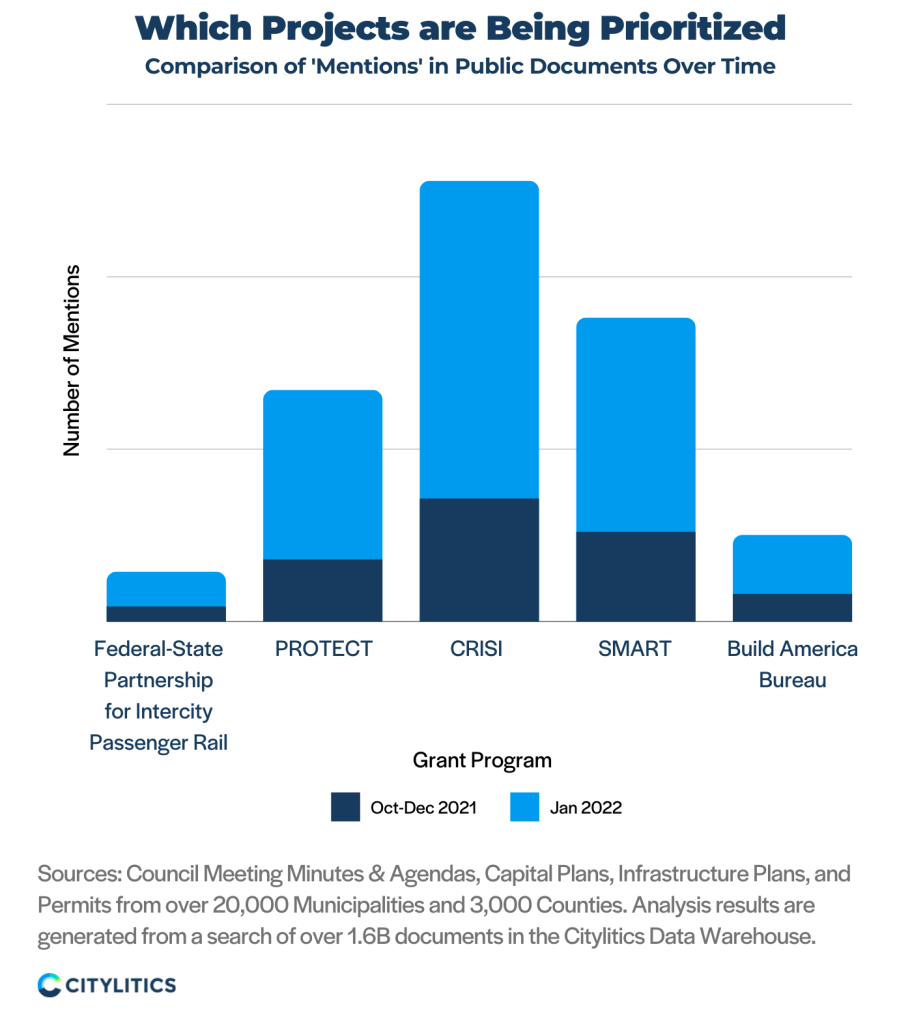

Which Project Are Being Prioritized?

To better understand changes in project prioritization stemming from Infrastructure Bill funding, Citylitics analyzed the frequency of planning conversations in relation to each of the Bill’s individual grant programs from October 2021 to the end of January 2022.

As indicated in the graph below, Citylitics found that the largest increase was in relation to the Promoting Resilient Operations for Transformative, Efficient, and Cost-Saving Transportation (PROTECT) program (172%), the Consolidated Rail Infrastructure and Safety Improvements (CRISI) program (158%), the Strengthening Mobility and Revolutionizing Transportation (SMART) program (138%), Build America Bureau program (113%).

Conclusion

The increased engagement around additional funding and project priorities seen from city governments signals the ongoing interest in larger, more ambitious projects. This mirrors the focus on transportation resiliency and reliability seen in the frequency of planning conversations tied to funding programs such as the Federal-State Partnership for Intercity Passenger Rail, PROTECT and CRISI. Industry professionals may wish to allocate greater time and resources to cities where there is an interest in large scale and transformative transportation initiatives that look to safeguard infrastructure for future generations of riders.

—–

Citylitics will continue to track and report on trends relating to the Bill over the coming months as planning discussions evolve across states and municipalities. Follow us on LinkedIn to make sure you don’t miss an update.

About Citylitics’ Data Engine

Citylitics aggregates over 1.6B public documents & records from 30,000 cities & utilities across the U.S. and Canada, making us the largest data engine in the industry and only source of predictive intelligence on where, how, and why upcoming investments will be made. Our data sources include capital plans, council meeting minutes & agendas, infrastructure plans, permits, financial data, and more.

Our intelligence aggregation system is unique in the industry as it allows us to collect content from websites and documents, index it, categorize it, and then make it available to our search algorithms and in-house Intelligence Analysts. We combine a balance of algorithm and data searching tools to comb through a vast dataset with applied expertise to filter out irrelevancy, resulting in best-fit opportunities.