Citylitics continues our analysis of emerging infrastructure market trends as a result of the Infrastructure Bill. We explore funding sources to highlight trends emerging from the Bill, aggregated from council meeting minutes & agendas, capital plans, infrastructure plans, and permits from over 20,000 municipalities and 3,000 counties. This includes references to those funding sources, or ‘mentions’, in public documents and surrounding context as of the end of February.

Which Regions are Project Hotspots?

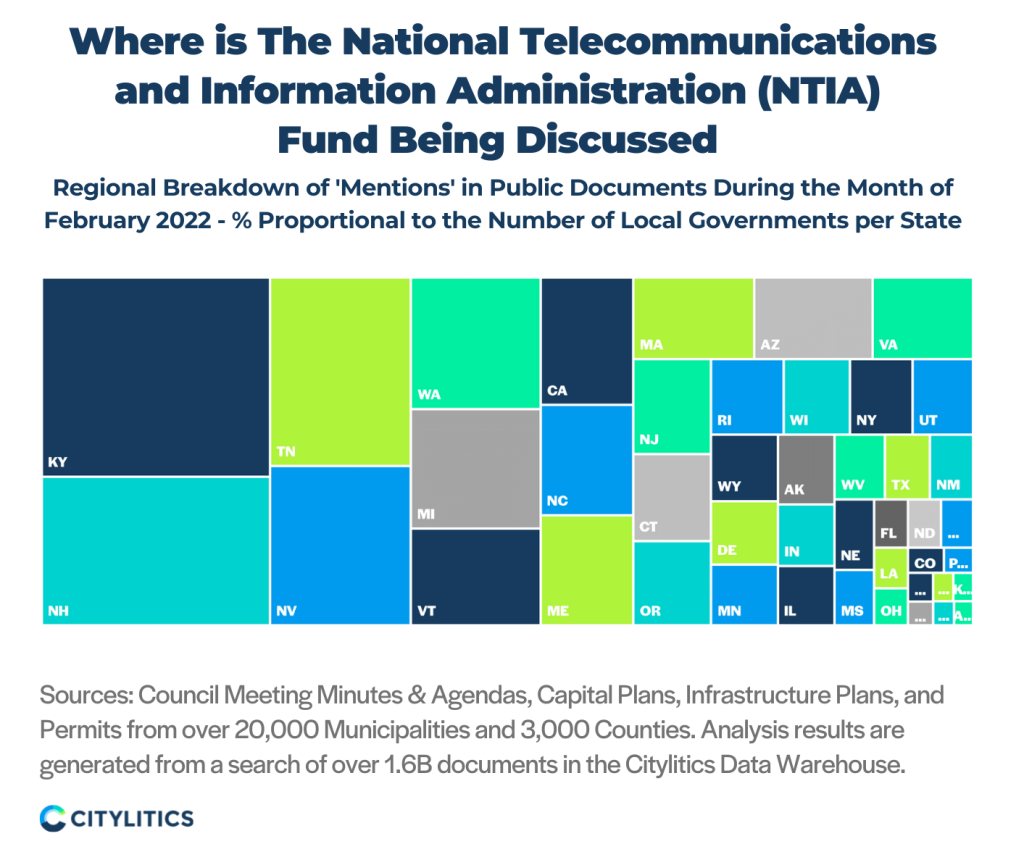

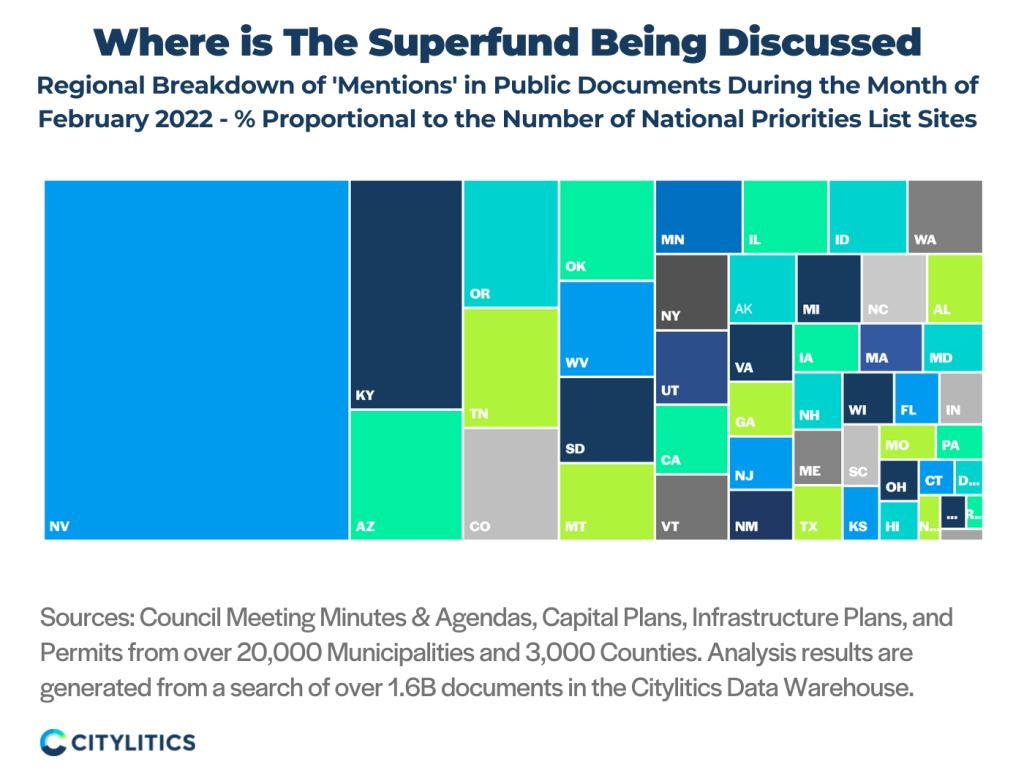

Some Infrastructure Bill funding sources such as the National Flood Insurance Program have seen a wide regional distribution of mentions during planning conversations. Others, such as the National Telecommunications and Information Administration (NTIA) Fund (below), and the Superfund (the Comprehensive Environmental Response, Compensation, and Liability Act) (also below) have been mentioned more frequently in particular regions.

Citylitics has found that in relation to the number of local governments per state, the National Telecommunications and Information Administration (NTIA) Fund was discussed most actively in Kentucky (85 mentions measured against 1,322 local governments), New Hampshire (26 mentions measured against 541 local governments), Tennessee (34 mentions measured against 906 local governments), and Nevada (6 mentions measured against 189 local governments) during the month of February.

When state-wide mentions of the Superfund were compared against the number of National Priorities List (NPL) sites, Citylitics found that planning conversations were focused in Nevada (47 mentions of the Superfund despite having only 1 NPL site), with Kentucky (133 mentions against 12 NPL sites) and Arizona (57 mentions against 9 NPL sites) emerging as additional hotspots during the month of February.

Conclusion

Clear regional hot spots are emerging around the mention of specific funding programs, notably the National Telecommunications and Information Administration (NTIA) Fund and Superfund.

Mentions of broadband have been steadily increasing in infrastructure planning discussions in relation to additional funding from the American Rescue Plan Act (ARPA) and the Infrastructure Bill. Regarding ARPA, Citylitics found that 34% of planning conversations in relation to infrastructure projects referenced broadband from February to July 2021. We also saw broadband project planning in light of Infrastructure Bill funding gain traction in December, with mentions of broadband appearing twice as much as mentions of climate resiliency, stormwater, and EV infrastructure projects.

Surplus funding from the Infrastructure Bill has given communities, including rural counties beyond Gig cities, the opportunity to focus on broadband infrastructure projects and improve connectivity for their constituents. We see this reflected in February’s data, with states such as Kentucky, New Hampshire, and Tennessee signaling heightened activity in processing applications for broadband funding.

Regarding the Superfund focus in Nevada, the EPA was actively engaged in planning conversations around the Carson River Mercury Site in Dayton, NV in February, likely giving cause to the frequency of mentions seen in Nevada during this time. For firms that are interested in getting involved in the project during its early-stages, this would be an indication that they are moving forward in processing their funding applications.

—–

Citylitics will continue to track and report on trends relating to the Bill over the coming months as planning discussions evolve across states and municipalities. Follow us on LinkedIn to make sure you don’t miss an update.

About Citylitics’ Data Engine

Citylitics aggregates over 1.6B public documents & records from 30,000 cities & utilities across the U.S. and Canada, making us the largest data engine in the industry and only source of predictive intelligence on where, how, and why upcoming investments will be made. Our data sources include capital plans, council meeting minutes & agendas, infrastructure plans, permits, financial data, and more.

Our intelligence aggregation system is unique in the industry as it allows us to collect content from websites and documents, index it, categorize it, and then make it available to our search algorithms and in-house Intelligence Analysts. We combine a balance of algorithm and data searching tools to comb through a vast dataset with applied expertise to filter out irrelevancy, resulting in best-fit opportunities.