Citylitics continues our analysis of emerging infrastructure market trends as a result of the Infrastructure Bill. We explore funding sources to highlight trends emerging from the Bill, aggregated from council meeting minutes & agendas, capital plans, infrastructure plans, and permits from over 20,000 municipalities and 3,000 counties. This includes references to the Bill, or ‘mentions’, in public documents and surrounding context throughout the month of November.

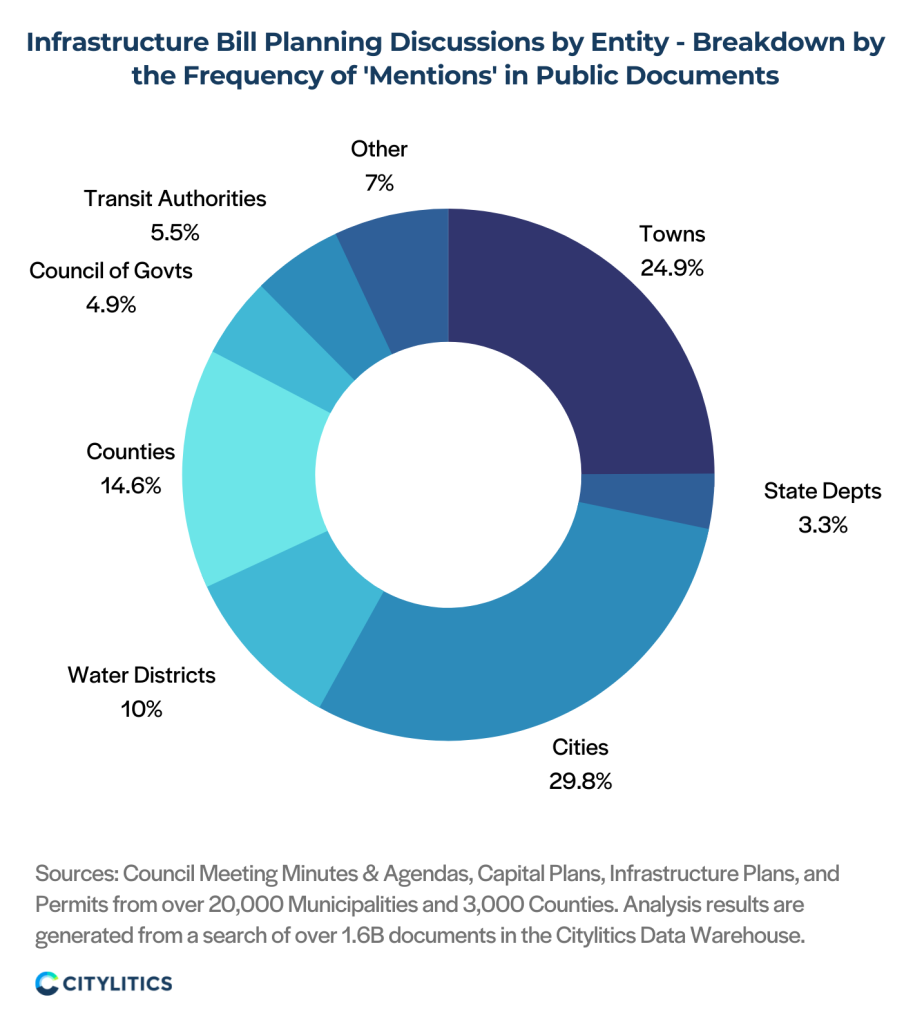

Which Entities Are Actively Discussing the Infrastructure Bill?

Within the first two weeks the Infrastructure Bill was passed, towns were most active in discussing what the increased funding would mean for ongoing and net new projects. However, as the month progressed, conversations shifted away from towns and into cities. By the end of November, conversations within city governments had nearly doubled as they became the most actively engaged in planning (29.8%). Engagement levels within counties remained relatively the same throughout the month while water/sewer districts and transportation authorities both saw a slight increase.

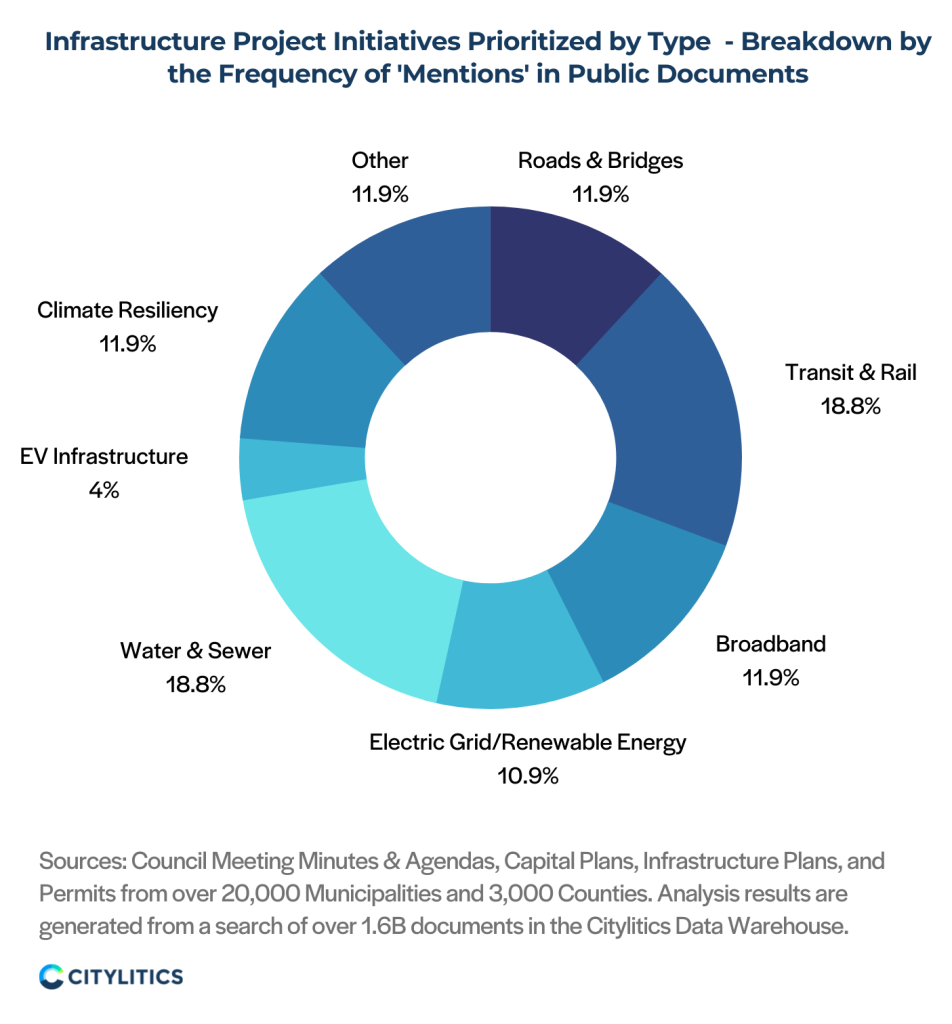

Which Project Are Being Prioritized?

Project types being prioritized during those conversations also pivoted during the month of November. While initially focused on road & bridge initiatives, planning conversations began to encompass other project types towards the end of the month, with road & bridge project prioritization declining by more than half (from 35% down to 12%).

Given the previous correlation found between larger entities, like cities, and more ambitious projects such as climate resiliency, it should come as no surprise that as cities became more active in planning, conversations around climate resiliency & sustainability projects increased dramatically (from 6% up to 12%). Along those same lines, the average size of entities interested in discussing EV infrastructure projects also rose significantly (from 261,827 to 787,090).

Transit & rail projects saw a slight increase in prioritization during planning conversations, while Broadband initiatives remained largely the same.

Conclusion

The increased engagement around additional funding and project priorities seen from city governments is an important pivot in trends arising from the Infrastructure Bill. It signals the emergence of larger, more ambitious projects that transcend market segments, presenting a unique opportunity for companies that offer multiple solutions. Given that climate resilience & sustainability initiatives often present project opportunities across water & wastewater, transportation, energy etc., building out a relationship in one area may open up project opportunities in others as well. For those companies who provide climate resiliency and related solutions, now is the time to align market positioning and set up initial meetings to help those cities better understand future state possibilities.

—–

Citylitics will continue to track and report on trends relating to the Bill over the coming months as planning discussions evolve across states and municipalities. Follow us on LinkedIn to make sure you don’t miss an update.

About Citylitics’ Data Engine

Citylitics aggregates over 1.6B public documents & records from 30,000 cities & utilities across the U.S. and Canada, making us the largest data engine in the industry and only source of predictive intelligence on where, how, and why upcoming investments will be made. Our data sources include capital plans, council meeting minutes & agendas, infrastructure plans, permits, financial data, and more.

Our intelligence aggregation system is unique in the industry as it allows us to collect content from websites and documents, index it, categorize it, and then make it available to our search algorithms and in-house Intelligence Analysts. We combine a balance of algorithm and data searching tools to comb through a vast dataset with applied expertise to filter out irrelevancy, resulting in best-fit opportunities.