More than ever, business development professionals in the infrastructure industry are finding that tried and true practices such as industry connections, trade shows, networking, site visits, sales channels, and travel no longer serve as reliable means by which to identify new targets in their early stages. The other downside to tried and true practices is that they don’t serve as a safety net to ensure every possible best fit opportunity is being identified – including those with budgets allocated.

In its place, precise, early stage intelligence enables sales teams to track all possible opportunities from their earliest stages; it also offers internal efficiencies to save time & resources in driving revenue growth. Many sales professionals are already aware of the unique benefits early stage intelligence delivers; however, not everyone is familiar with the budget required. Here, we outline the key considerations associated with early stage intelligence based on business development strategies and needs.

Initial Considerations

Reviewing business development goals and looking at past successes are key considerations before allocating a budget. In reviewing short- and long-term goals for both your team and your organization, how will early stage intelligence help you drive efficiencies to grow your pipeline and customer base?

Key questions to ask yourself during the consideration phase include:

- What product lines are you unable to find enough new opportunities for?

- What geographies do you feel you have poor market visibility into?

- What types of project opportunities does your organization have a strategic advantage in?

- In what markets and geographic regions are your strongest relationships and customer base situated, and where do you have significant gaps in relationships and references?

The answers to the questions above should align with your current strategy. There are also benefits to reflecting on current ROI and what existing programs/tools are not generating the ROI or business value you want to see. For example, what lessons can be learned in identifying areas of least return?

Two questions that often get missed during the consideration phase centre on the dynamics between internal teams and between competitors in your market. Ask yourself:

- What other business needs can be addressed with the same intelligence gaps (Ex. product teams, R&D, account management etc.)? Efficiencies and gains realized by other teams will often help to drive the sales pipeline (Ex. successfully run marketing campaigns that support sales efforts).

- How competitive is your particular market? How many opportunities become available within a given year and how difficult is it to find face time with the prospect to differentiate yourself?

Budgeting Based on Strategy & Need

Early stage intelligence facilitates a number of different business development strategies. Outlined below are key budgeting considerations based on three different goals:

- Getting ahead of the RFP.

- Focusing on higher potential, more profitable opportunities.

- Identifying strategic initiatives for niche markets or geographic growth.

Getting Ahead of the RFP

Identifying and pursuing opportunities before the RFP is invaluable as it allows for time to allocate resources and preposition your organization and solution. Business development professionals are looking to understand what intelligence they need, which customers they should be targeting, and from there, prompting their sales team to begin planning and prospecting.

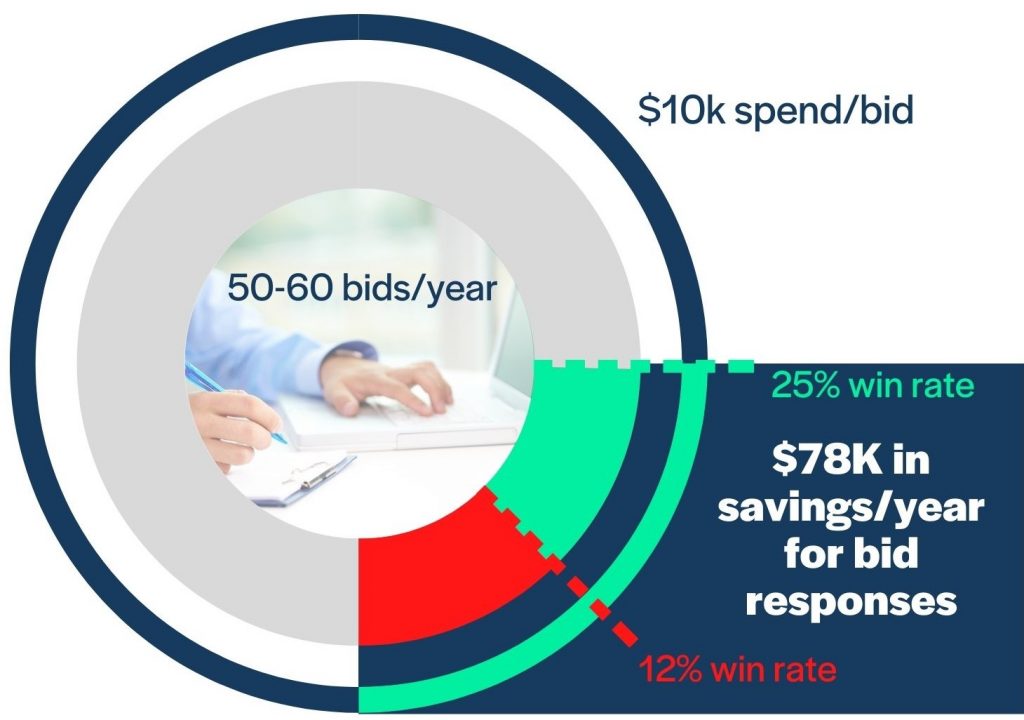

On average, it costs $10k to respond to a bid, based on the allocation of time and resources. As an example, if your current win rate without early stage intelligence is 12% and you respond to 50-60 bids per year, then an increased win rate of 25% (as we’ve seen generated across our client base) would considerably decrease the cost as you scale, with $78k in savings per year for bid responses.

Focusing on Better Opportunities vs. More Opportunities

We often hear from infrastructure industry professionals that they are looking to focus their sales team’s efforts on better opportunities, as opposed to looking for more opportunities that are unlikely to materialize. In a competitive market, finding efficiencies around identifying opportunities they are more likely to win and that are more profitable is crucial.

Incorporating early stage intelligence allows you to be precise about who you want to be targeting and what intelligence you need. It also provides context you can share with your sales team in order to begin prospecting. If your team is currently spending 70% of their time on opportunities that aren’t materializing into projects, you can expect to see that time cut in half through the incorporation of early stage intelligence.

Early stage intelligence allows time to vet opportunities to determine whether they are worth pursuing or not, as opposed to hearing about the opportunity near or at the RFP stage, and responding under pressure. The time saved from responding to bad fit opportunities has a significant impact on a business’s business development budget. For example, cutting down 20% of sales time spent on poor fit opportunities means $400k/year in savings for an annual business development budget of $2 Million.

Identifying Strategic Initiatives for Niche Markets or Geographic Growth

Some initiatives are more strategic in nature, for example finding more PFAS project opportunities or supporting a growth strategy in a particular geographic region. Although these opportunities can see huge gains for business development teams, they often take 1-2 years to come to market. They also are not the type of project opportunities that spread as easily through contact networks – leaving many industry professionals with market blind spots.

Early stage intelligence allows industry professionals to follow strategic initiatives from their earliest stages so that they can begin prospecting when it makes sense for their organization. As a result, early stage intelligence reporting can serve as added safety net, ensuring opportunities best suited to an organization’s goals, and those with multi million dollar budgets, are not being missed.

Summary

As outlined above, early stage intelligence drives ROI for business development teams in infrastructure markets by saving time and resources on bid responses. It also allows team to better focus their efforts to see the greatest results, and supports strategic initiatives including geographic growth.

The numbers speak for themselves in terms of ROI achieved with early stage intelligence:

- Sales operational savings of $78k/year by improving bid win rate from 12% to 25%, assuming $10k in bid response cost.

- Time savings of $400k/year for an annual business development budget of $2 Million by focusing on best fit opportunities.

- Identification of projects with multi-million dollar budgets that would have been lost revenue otherwise.

With the outlook for 2021 and coming years brimming with optimism and investment in infrastructure projects, the ability to leverage early stage – and precise – intelligence is a clear advantage companies can no longer ignore. Those companies that factor the considerations above into their strategy and budget will not only see a higher ROI, but also greater market visibility and competitive insight, with the ability to plan ahead of the RFP to separate themselves from the competition as an industry leader.