One of the biggest challenges facing the infrastructure industry at present is the ongoing constraint to supply chains. Citylitics analyzed the ways in which supply issues are impacting infrastructure projects, aggregated from council meeting minutes & agendas, capital plans, infrastructure plans, and permits from over 20,000 municipalities and 3,000 counties. This includes public documentation with explicit reference to public works projects impacted by supply chain issues within the first few months of 2022.

How are Supply Chain Issues Impacting Project Implementation?

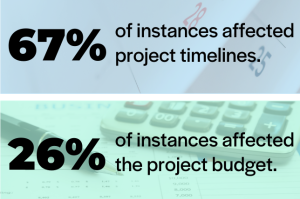

In most cases (67% of public documents that cite supply chain issues i n 2022), project timelines have been increased, with public transit and vehicle procurement the most affected in this regard. Faced with having to rely on limited fleets as they deal with procurement delays, some public works departments have chosen to advance their procurement timelines in anticipation of delays in materials and equipment, while a smaller few have made moves to accelerate the purchase of vehicles.

n 2022), project timelines have been increased, with public transit and vehicle procurement the most affected in this regard. Faced with having to rely on limited fleets as they deal with procurement delays, some public works departments have chosen to advance their procurement timelines in anticipation of delays in materials and equipment, while a smaller few have made moves to accelerate the purchase of vehicles.

To a lesser extent (26% of documents citing supply chain issues in 2022), budgets were found to be impacted. In some cases, existing contracts needed to be amended to accommodate higher material costs, while in others, suppliers were not receiving bids, requiring the need for alternative solutions. The impact to project budget was seen most frequently in relation to road and bridge infrastructure projects, which represented a fifth of all project budget increases.

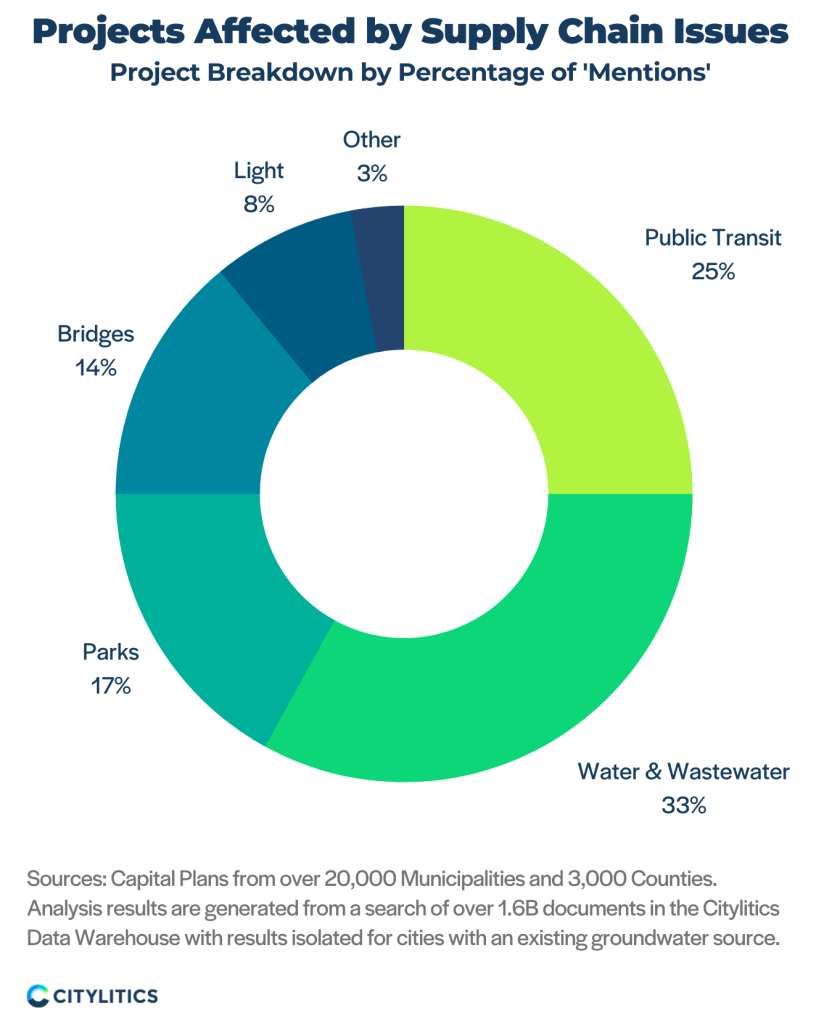

Which Project Types have been Affected Most?

As shown below, water & wastewater projects (33%) have been the most affected by supply chain issues, with public transit (25%) a close second. Parks (17%) and bridges (14%) have also been affected as a result of materials needed.

This is consistent with what the American Water Work Association (AWWA) reported in October as part of their COVID Water Sector Impact Study, where they noted that “over 70% of utilities currently face supply chain issues for pipes and other infrastructure components”.

Key Themes

Across infrastructure markets, two key themes have emerged. On the one hand, less urgent projects are being pushed back, with implications of:

- Reduced budgets

- Re-evaluation of project plans and timelines

- An impact to budgeting and contingency planning for future years

For those projects deemed to be more urgent in nature, we’re seeing these being pushed through, though with the result being:

- Ballooning budgets and/or procurement contracts being pushed through earlier

- Risk evaluations taking place

- Reallocation of funds and resources from other projects and/or departments

Conclusion

The water & wastewater market appears to be the heaviest hit by a shortage of pipe and material components. When the AWWA investigated amongst utilities, they noted that utilities are dealing with the issue by pre-ordering, stockpiling, and even delaying projects due to material shortages.

For those in the transportation market, constraints on materials needed for fleets means procurement deadlines are being advanced, while road and bridge projects run the risk of over budgeting.

Now, more than ever, advanced project forecasting and a clear understanding of municipal and utility budgets is needed to ensure a strong project pipeline.

—–

For more market trends, check out our most recent series where we track and report on trends emerging to funding sources tied to the Infrastructure Investment and Jobs Act (IIJA). Follow us on LinkedIn to make sure you don’t miss an update.

About Citylitics’ Data Engine

Citylitics aggregates over 1.6B public documents & records from 30,000 cities & utilities across the U.S. and Canada, making us the largest data engine in the industry and only source of predictive intelligence on where, how, and why upcoming investments will be made. Our data sources include capital plans, council meeting minutes & agendas, infrastructure plans, permits, financial data, and more.

Our intelligence aggregation system is unique in the industry as it allows us to collect content from websites and documents, index it, categorize it, and then make it available to our search algorithms and in-house Intelligence Analysts. We combine a balance of algorithm and data searching tools to comb through a vast dataset with applied expertise to filter out irrelevancy, resulting in best-fit opportunities.