As the United Nations Water aptly points out, the impact of groundwater is visible everywhere. Worsening climate change continues to place a greater burden on groundwater availability and our ability to manage this resource through water-use efficiency and innovative storage initiatives.

Citylitics has tapped into our data engine and aggregated data from council meeting minutes & agendas, capital plans, infrastructure plans, and permits from over 20,000 municipalities and 3,000 counties to bring to light groundwater infrastructure funding hotspots and key projects where industry professionals may wish to get involved.

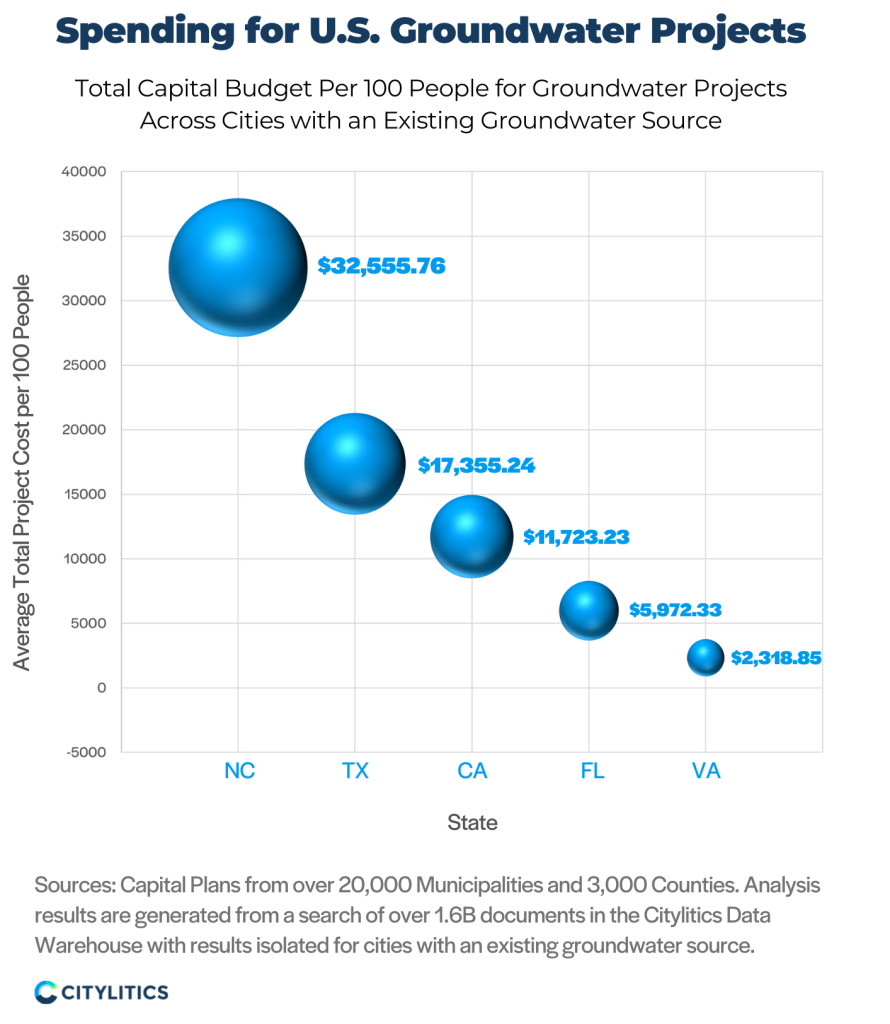

Regional Hotspots for Groundwater Project Spending

Capital improvement plans across U.S. cities with a groundwater source indicate that North Carolina is the highest spending region for groundwater projects ($32,555.76 per 100 people), followed by Texas ($17,355.24 per 100 people), and California ($11,723.23 per 100 people).

Within North Carolina itself, the City of Jacksonville is the highest spending locale with a total project cost of $7,596,500. Jacksonville contains numerous wells constructed in the late 1950s that need significant repair and improvements, which are referenced as project justification as part of this funding allocation. The City of Clinton is the second highest spending local with a total project cost of $4,836,000 dedicated entirely to increasing water production capacity.

In Texas, we’ve found that the highest spending region is the City of Houston with a total project spend of $50,845,000 for groundwater infrastructure initiatives, followed by the City of Sugar Land, where they have allocated $31,188,000 as total project spend. In Houston, capital improvement plans reference improvements to well performance, reliability, and demand as justification for spending allocation.

California, meanwhile, shows a significant project funding in the County of San Bernardino where they’ve allocated $226,344,643 as total project spend, much of which is due to groundwater remediation needed in conjunction with the Chino Airport.

Key Groundwater Projects

While California may not be the top spending U.S. state for groundwater projects overall, their high population and water scarcity are driving larger infrastructure projects with the focus on water storage and new water sources rather than groundwater projects focused on issues of water quality and containment remediation. Citylitics has identified three such projects below with funding potential.

1) North Marin Water District, CA– New Supply Options Sought for the Counties Two Largest Water Agencies

The district’s 60,000 residents in the greater Novato area get 75% of their water from the Sonoma Water imports with the remaining 25% coming from the district’s only reservoir, Stafford Lake. Stafford Lake would have gone dry last summer had the district not purchased and pumped in Russian River water during the winter of 2020-2021.

As referenced during the district’s board meeting on January 25th, the Novato basin is thin in comparison with other groundwater basins in California and can only hold about 50 to 100 acre-feet of water. Groundwater could be extracted from or recharged into the

basin at a rate of tens of gallons per minute, while other basins have a rate in the low hundreds or thousands of gallons per minute, according to West Yost Associates. However, the district could partner with other groundwater storage projects in the region, such as one being studied by the Sonoma Water agency.

2) San Joaquin County, CA—Demonstration Recharge, Extraction, and Aquifer Management (DREAM) Project

The DREAM Project aims to develop a successful pilot scale groundwater banking project in Eastern San Joaquin County to provide the North San Joaquin Water Conversati

on District (NSJWCD) with up to 1,000 AF of East Bay Municipal Utility District (EBMUD) surface water from the Mokelumne River, instead of pumping groundwater from the Eastern San Joaquin Subbasin, thereby storing groundwater for future use.

The county believes that it, and its regional partner, the EBMUD may be uniquely positioned to seek State and Federal funding for future phases of the project on the basis of inter-regional and groundwater storage aspects of the project.

3) The Metropolitan Water District of Southern California – $7 Million Financed for Groundwater Recovery Projects

According to The Metropolitan Water District of Southern California 2022 Achievement Report, from July 2020 to June 2021, $7 million was financed by the District to support projects that produced about 48,000 acre-feet of recovered groundwater for municipal use.

Metropolitan partners with local agencies to store imported surface water in groundwater basins for use in times of shortage under conjunctive-use agreements. Metropolitan currently has nine storage projects with nearly 212,000 acre-feet of storage capacity. This allows Metropolitan to store up to 53,000 acre-feet per year and withdraw up to 71,000 acre-feet annually during shortage years. In fiscal year 2020/21, Metropolitan extracted about 23,000 acre-feet of previously stored water to support the ongoing drought effort.

Conclusion

As we saw with initiatives tied to the American Rescue Plan Act and the Infrastructure Bill, clear regional hotspots exist in relation to groundwater infrastructure projects. In particular, North Carolina has emerged as a leader in groundwater infrastructure spending, primarily due to aging infrastructure and capacity limitations. Texas is another regional hotspot similarly driven by population and efficiency needs.

California has a few larger projects where collaboration with other water agencies could open up larger opportunities as the projects progress. When an increasing percentage of the water supply in the southern half of the state comes from conservation, recycling, and recovered groundwater, relationships built through successful groundwater projects could also lead to additional water projects in future.

—–

Citylitics tracks and reports on infrastructure trends across all industries, including following the ebb and flow of Infrastructure Bill funding planning conversations. Follow us on LinkedIn to make sure you don’t miss an update.

About Citylitics’ Data Engine

Citylitics aggregates over 1.6B public documents & records from 30,000 cities & utilities across the U.S. and Canada, making us the largest data engine in the industry and only source of predictive intelligence on where, how, and why upcoming investments will be made. Our data sources include capital plans, council meeting minutes & agendas, infrastructure plans, permits, financial data, and more.

Our intelligence aggregation system is unique in the industry as it allows us to collect content from websites and documents, index it, categorize it, and then make it available to our search algorithms and in-house Intelligence Analysts. We combine a balance of algorithm and data searching tools to comb through a vast dataset with applied expertise to filter out irrelevancy, resulting in best-fit opportunities.