As we continue to follow news regarding the upcoming U.S. infrastructure investment boom, we’re growing increasingly excited about the possibilities for future infrastructure projects: from new highways and bridges, through to innovative transit solutions, water and wastewater infrastructure investment, hydroelectric dams, and the greater flexibility and financial resources for municipalities to embrace new technologies and solutions to address infrastructure needs.

Mega trends such as government stimulus programs, recalibrating infrastructure needs, extreme weather events, and public sector digitization will not only continue to drive infrastructure investments for years to come, but also open-up opportunities for the industry to address infrastructure needs in new and more efficient ways.

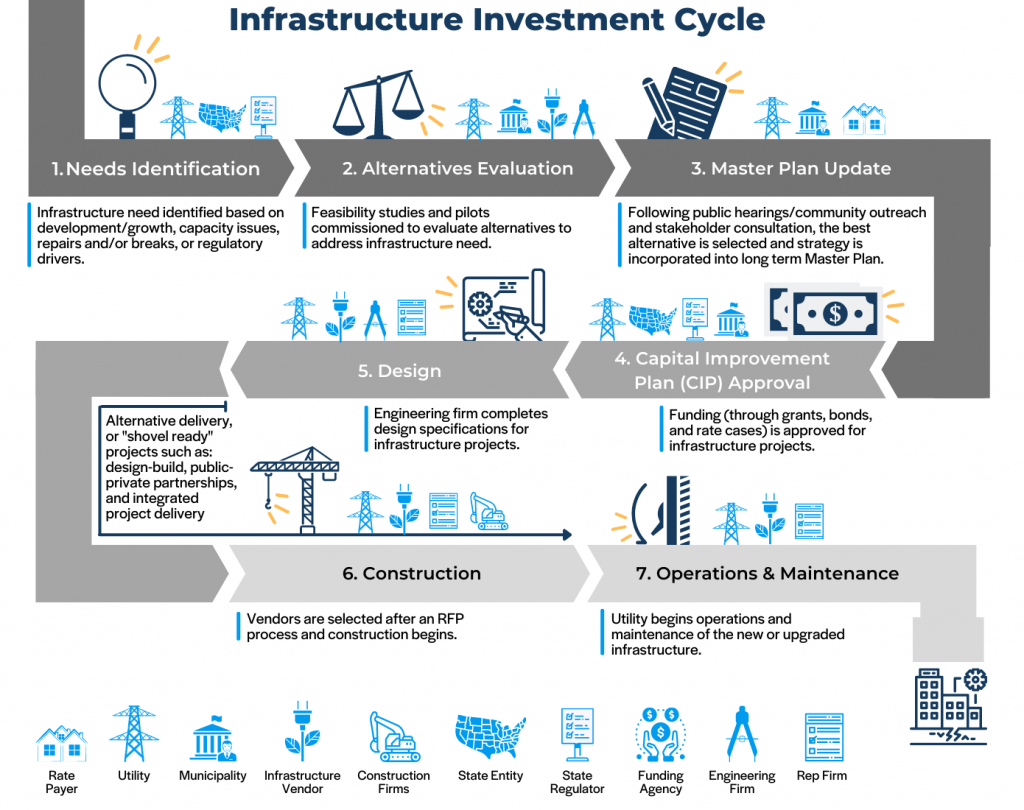

However, before all of these new projects make their way to RFP, there are a number of steps that business development professionals in the infrastructure industry will want to track. To better visualize these steps and help industry professionals prepare ahead of the investment expansion, we’ve created the infographic below:

Entities Involved in the Infrastructure Market

A. Rate Payer: Residents who receive and pay for water/sewer services from the local water/wastewater utility.

B. Utility: Entities that deliver communities with electricity, gas, water, or sewerage by maintaining and operating the facilities that deliver such services. For example, D.C. Water or American Electric Power.

C. Municipality: The governing body of a city or town. It has corporate status and powers of self-government as granted by national and/or state laws, like the City of Chicago.

D. Infrastructure Vendor: A business that develops and manufactures products and services such as equipment, chemicals, software, or pipes that are used by utilities to address infrastructure needs. Examples include: SUEZ, Siemens, Mueller, and ABB.

E. EPA (Environmental Protection Agency): The agency of the Federal U.S. government responsible for writing and enforcing environmental laws passed by Congress.

F. State Entity: An agency, authority, office etc. of the state that oversees regulations and policies related to infrastructure. For example, the Department of Transportation (DOT) is responsible for developing and coordinating policies for transportation & infrastructure projects. The term state entity also applies to the environmental agencies of each U.S. state that oversee all aspects of planning, permitting, and monitoring the state’s environmental resources. For example, the Texas Commission on Environmental Quality and the California EPA are both state regulators. The DOT also oversees municipal transportation bodies like Metropolitan Planning Organizations and Rural Transportation Planning Organizations.

- Federal Railroad Administration (FRA): Enables the safe, reliable, and efficient movement of people and goods along the Nation’s railroads.

- Federal Highway Administration (FHWA): Provides stewardship over the construction, maintenance and preservation of the Nation’s highways, bridges and tunnels.

- Federal Aviation Administration (FAA): Responsible for regulating all aspects of civilian aviation in the nation.

- Federal Transit Administration (FTA): Provides financial and technical assistance to local public transit systems, including buses, subways, light rail, commuter rail, trolleys and ferries.

Note that the Environment team within the DOT’s Office of Policy Development, Strategic Planning and Performance works across the spectrum of energy and environmental issues, coordinating across DOT’s modes and with other Federal agencies to ensure that the environmental impacts of transportation policies are considered at all levels. The team is responsible for developing and reviewing transportation legislation and regulations and coordinating national transportation policy initiatives relating to energy and the environment.

For a full listing of environmental agencies by state, see The Environmental Protection Agency.

G. Funding Agency: A government body that provides financial assistance through loans or grants for infrastructure projects. For example, The U.S. Department of Transportation, The Environmental Protection Agency, the U.S. Department of the Treasury, and the U.S. Bureau of Reclamation.

H. Engineering Firm: Firms that provide planning, engineering, and design services to municipalities and utilities, like Jacobs, Black & Veatch, and Hazen & Sawyer.

I. Contractor: Project delivery firms that provide construction management services and project delivery methods to municipalities and utilities. Examples include Bechtel and Kiewit.

J. Rep Firm: Manufacturers Representative firms that supply processes and equipment for infrastructure in their local territories.

Infrastructure Investment Cycle

1. Needs Identification

There are several drivers for infrastructure needs. Internally, the utility may proactively recognize that their infrastructure is nearing capacity and needs an upgrade. Or, they may be facing recurring infrastructure breaks or water quality issues that drive the need for upgrades or repairs. This identification may also be prompted by the EPA and/or State Regulators recognizing that the utility is at risk of violating, or has violated, permit and must update their infrastructure to meet regulations.

2. Alternatives Evaluation

Once needs have been identified, a municipality or utility will commission an engineering firm to execute feasibility studies and develop alternative strategies to address their infrastructure needs. This is also the stage at which pilots and presentations from technology companies may happen.

3. Master Plan Update

Next, the utility will update their Master Plan to include their planned infrastructure upgrades, based on the strategy that they have selected once they have evaluated their alternatives. The plans will then be communicated to rate payers through public hearings or council meetings.

4. Capital Improvement Plan (CIP) Approval

The utility then seeks funding for the infrastructure project(s), through rate cases, bond markets, and grant or loan programs. The utility will update their projects’ 5-year CIP to correspond with any funding approval.

5. Design

An RFP is issued by the utility for the design of infrastructure project(s) to be completed by engineering firms. During this design phase, specifications for tech company products or solutions will be decided on by the engineering firm and the utility.

Note that alternative delivery projects such as design-build, public-private partnerships, and integrated project delivery will proceed from this phase to Operations & Maintenance, without the need to bid on an RFP.

6. Construction

The utility will then issue an RFP for the construction of infrastructure projects. Contractors and Rep Firms respond to the RFP and the winning contractor bid begins to manage the construction of the infrastructure project.

7. Operations & Maintenance

The utility takes on the operations of the new infrastructure or infrastructure upgrade. Rep Firms and infrastructure tech companies will still stay in contact for any after-market or retrofit needs that may occur.

Summary

While we see varied market strategies from industry professionals to successfully engage in the steps of the infrastructure investment cycle outlined above, one aspect remains the same. Precise, Early-Stage Sales Intelligence is essential for business development teams to track what is going on at a municipal level so that they can:

- Combat the long sales cycle.

- Better allocate time to relationships that require the most attention, whether to focus on new relationships to develop an existing opportunity, based on timing & intelligence.

- Target high potential utilities at the right time.

- Educate public entities on how their specific expertise sets them apart from the competition.

- Forecast and plan ahead of upcoming bids to ensure a prepared, well articulated, and competitive RFP response.

Early-Stage Sales Intelligence extracted from meeting minutes, infrastructure plans, engineering studies, budgets, compliance violations, capital improvement plans, public notes, and other such documents can help to answer questions like:

- “What is the scope of each city’s needs?”

- “Does the city have budget allocated to spend on this infrastructure project?”

- “Who are existing engineers and vendors of choice?”

- “What is the delivery method likely going to be?”

As business development professionals know, preparation ahead of the RFP is key to the right allocation of resources, time, and money – and only Early-Stage Sales Intelligence can provide this level of foresight.

For more information on the coming infrastructure investment boom and the ways in which companies can take advantage Early-Stage Sales Intelligence, check out our blog article “Preparing Your Business Development Teams For The Infrastructure Investment Boom”.